Dubai, UAE: Mashreq, one of the leading financial institutions in the MENA region, reported its financial results for the year 2024.

Key Highlights:

- Net Profit

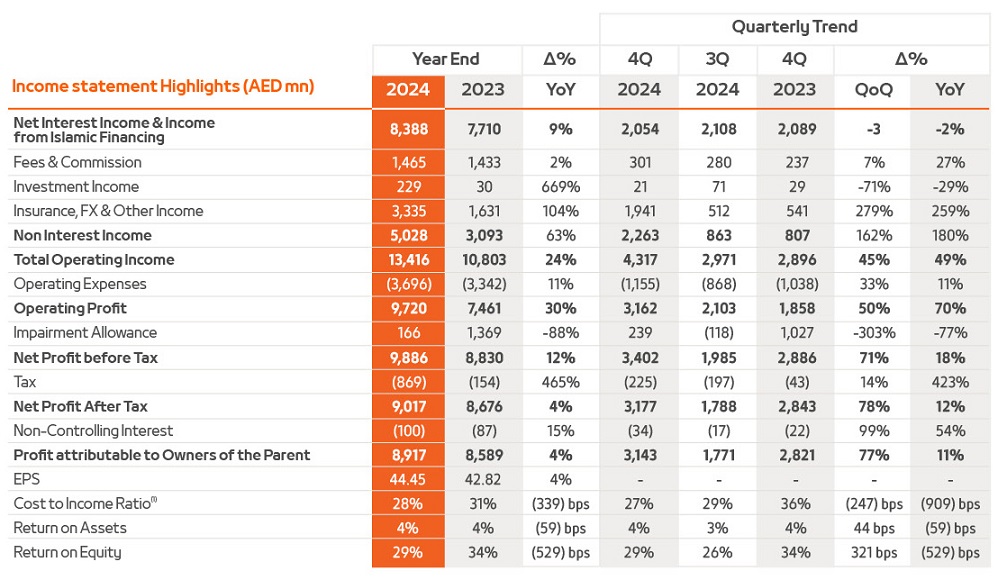

Double digit growth in Net Profit Before Tax reflects both the operational efficiency and revenue momentum. A clear indication of the ability to generate industry-leading shareholder value.

- Net Profit Before Tax reached AED 9.9 billion, a 12% increase in 2024 and underlining Mashreq’s solid financial foundation and efficient cost management.

- Even after an AED 869 million tax payment, Net Profit After Tax grew to AED 9 billion and increased 78% quarter on quarter and 4% year-on-year.

- Revenues

Mashreq achieved AED 13.4 billion in revenue, representing a 24% increase year-on-year and maintaining an impressive three-year CAGR of 32%. This remarkable growth demonstrates Mashreq’s ability to harness market opportunities effectively and build diversified income streams.

- Net Interest Income grew by 9% year-on-year despite interest rate cuts in 2024, reflecting healthy margins on the back of strong high-quality balance sheet growth.

- Non-Interest Income surged by 63% to AED 5 billion highlighting the continued emphasis on diversifying revenue streams through robust fee-generating activities and strong client engagement in FX, derivatives, and commodities.

- Growth in Non-Interest Income reflects the resilience and scalability of Mashreq’s business model, which continues to perform strongly amidst evolving interest rate environments.

- Mashreq recognized a one-off net gain of AED 1.2 billion from the strategic partial sale of a subsidiary, demonstrating its ability to identify and capitalize on value-accretive market opportunities.

- Expenses

Efficiency gains reflect the ongoing success in optimizing operational efficiency and advancing digital transformation initiatives, while allowing for strategic investments.

- Cost-to-Income Ratio improved by 339 bps to 28%(1) in 2024.

- This improvement was registered despite an increase in operating expense by 11% year-on-year in 2024.

- Balance Sheet

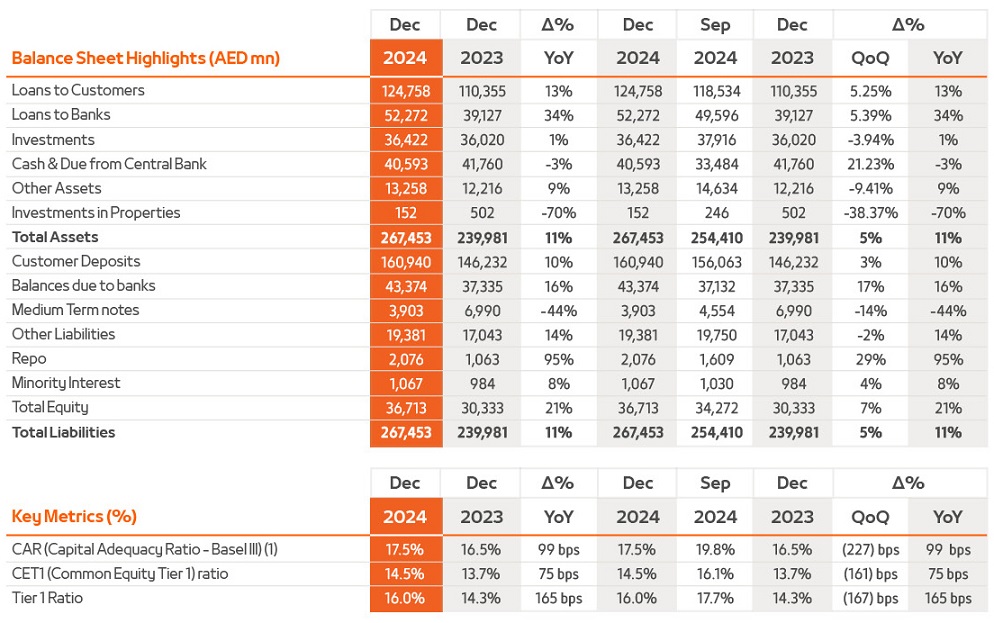

2024 witnessed an impressive loan growth of 18%, largely funded by an increase in customer deposits.

- Total assets increased by 11% year-on-year to AED 267 billion, driven by loan growth across wholesale and retail financings.

- Customer deposits increased to AED 161 billion in both wholesale and retail segments, with CASA now representing 66% of total customer deposits.

- Liquidity and Capital

Mashreq maintained a robust liquidity and capital position, reinforcing its ability to support growth while safeguarding against potential market disruptions.

- Liquid Assets Ratio was 34% and Liquidity Coverage Ratio stood at 150%, reflecting a prudent approach to liquidity management and the ability to exceed regulatory requirements.

- Capitalization metrics further strengthened compared to FY 2023, with Capital Adequacy Ratio increasing to 17.5%(2), Tier 1 Capital Ratio rising to 16%, and CET1 Ratio reaching 14.5%.

- These levels highlight Mashreq’s sound capital management strategy, which ensures a solid foundation for further growth.

- Asset Quality

Mashreq has continued to set industry benchmarks in credit quality, showcasing its strategic focus on prudent lending and robust asset monitoring practices.

- Net release of AED 166 million in allowances for impairments was achieved through high recoveries from Non-Performing Loans and disciplined credit risk management and marks the second year of net releases.

- The Non-Performing Loans to Gross Loans ratio of 1.35% (1.30% in FY 2023) at the close of 2024 reflects one of the lowest levels in the industry, highlighting Mashreq’s disciplined and effective risk mitigation measures.

- Coverage Ratio of 209% in 2024 (247% in FY2023) is amongst the strongest in the sector and demonstrates the prudent approach to safeguarding against potential credit losses while ensuring sufficient provisions to withstand market volatility.

| 9.9 Billion AED Net Profit Before Tax (AED 9 Billion Net Profit After Tax) |

13.4 Billion AED Revenue |

24% Revenue Growth |

|||

| 9.7 Billion AED Operating Profit |

30% Operating Profit Growth |

10% Customer Deposits Growth (CASA 66%) |

|||

| 18% Loans & Advances Growth |

4% Net Interest Margin |

29% Return on equity |

|||

| 3.5% Return on assets |

28% Cost to Income Ratio (1) |

17.5% Capital Adequacy Ratio (2) |

|||

| 1.35% NPL gross loans ratio |

|||||

H.E AbdulAziz Al Ghurair, Chairman of Mashreq:

“As we reflect on 2024, Mashreq’s journey stands as a testament to resilience, innovation, and excellence amidst a dynamic global and regional environment. The UAE’s remarkable progress, marked by its embrace of innovation and steadfast focus on economic diversification, reinforces its position as a global hub for trade, finance, and technology.

This year, Mashreq achieved record-breaking financial results, including a net profit before tax of AED 9.9 billion, alongside exceptional growth in our digital and international operations. These milestones reflect our unwavering commitment to delivering value to our stakeholders while aligning with the UAE’s vision for sustainable growth and global leadership.

Looking ahead, we will continue to leverage our agility, adaptability, and innovation to shape the region’s financial ecosystem. Mashreq remains committed to driving sustainable growth, empowering communities, and supporting the UAE’s broader aspirations as we navigate an everevolving economic landscape.”

H.E AbdulAziz Al Ghurair, Chairman of Mashreq:

“As we reflect on 2024, Mashreq’s journey stands as a testament to resilience, innovation, and excellence amidst a dynamic global and regional environment. The UAE’s remarkable progress, marked by its embrace of innovation and steadfast focus on economic diversification, reinforces its position as a global hub for trade, finance, and technology.

This year, Mashreq achieved record-breaking financial results, including a net profit before tax of AED 9.9 billion, alongside exceptional growth in our digital and international operations. These milestones reflect our unwavering commitment to delivering value to our stakeholders while aligning with the UAE’s vision for sustainable growth and global leadership.

Looking ahead, we will continue to leverage our agility, adaptability, and innovation to shape the region’s financial ecosystem. Mashreq remains committed to driving sustainable growth, empowering communities, and supporting the UAE’s broader aspirations as we navigate an everevolving economic landscape.”

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq:

“2024 has been another transformative year for Mashreq, marked by record-breaking achievements and a steadfast commitment to delivering value for our customers, stakeholders, and communities. Our 24% year-on-year revenue growth and an impressive Return on Equity of 29% reflect the success of our strategy and our ability to adapt and thrive in dynamic market conditions.

This year, we achieved phenomenal growth across several markets, including India, Hong Kong, and the GCC. Our entry into Pakistan, where we became the first bank to secure a restricted pilot license for digital retail banking, represents a significant milestone in our journey to foster financial inclusion. Additionally, the launch of Mashreq NEO in Egypt and our ranking as the fastest-growing banking brand in the region by Brand Finance further solidify our leadership in innovation and

customer-centric solutions.

At the core of our success is a relentless focus on digital transformation. The expansion of the NEO CORP platform across the GCC and the introduction of groundbreaking initiatives like Egypt’s first-ever banking-as-a-service partnership with e& demonstrate how we are redefining financial services.

Sustainability has also been a critical focus for Mashreq in 2024. Through our award-winning Climb2Change initiatives and several landmark sustainability-linked loan deals, we continue to integrate ESG principles into our operations and deliver transformative impact for our clients and the communities we serve.

Our foremost priority remains delivering exceptional experiences for our clients while empowering our people to excel. As we look to 2025, Mashreq’s vision to be the region’s most progressive challenger bank is stronger than ever. We will continue to embrace change, leverage technology, deliver client excellence, and drive innovation to shape the future of banking in our markets, ensuring we create lasting value for all our stakeholders.”

Looking Ahead

Mashreq’s performance in 2024 underscores its position as a forward-thinking financial institution that excels in delivering value to stakeholders through innovation, resilience, and a commitment to excellence. The Bank’s ability to achieve record-breaking financial metrics, including double-digit revenue growth and an impressive Return on Equity of 29%, reflects its robust strategy and operational discipline.

As Mashreq continues to prioritize its clients, enhance its digital capabilities, and solidify its financial foundations, it remains steadfast in its mission to foster long-term growth for shareholders while navigating a complex and dynamic global environment. The exceptional credit quality, bolstered by a disciplined risk management framework, and the impressive operational efficiency provide a strong platform for sustained success.

Note: Figures may not add up due to rounding differences

1. Post proposed dividend for the financial year 2024.

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq:

“2024 has been another transformative year for Mashreq, marked by record-breaking achievements and a steadfast commitment to delivering value for our customers, stakeholders, and communities. Our 24% year-on-year revenue growth and an impressive Return on Equity of 29% reflect the success of our strategy and our ability to adapt and thrive in dynamic market conditions.

This year, we achieved phenomenal growth across several markets, including India, Hong Kong, and the GCC. Our entry into Pakistan, where we became the first bank to secure a restricted pilot license for digital retail banking, represents a significant milestone in our journey to foster financial inclusion. Additionally, the launch of Mashreq NEO in Egypt and our ranking as the fastest-growing banking brand in the region by Brand Finance further solidify our leadership in innovation and

customer-centric solutions.

At the core of our success is a relentless focus on digital transformation. The expansion of the NEO CORP platform across the GCC and the introduction of groundbreaking initiatives like Egypt’s first-ever banking-as-a-service partnership with e& demonstrate how we are redefining financial services.

Sustainability has also been a critical focus for Mashreq in 2024. Through our award-winning Climb2Change initiatives and several landmark sustainability-linked loan deals, we continue to integrate ESG principles into our operations and deliver transformative impact for our clients and the communities we serve.

Our foremost priority remains delivering exceptional experiences for our clients while empowering our people to excel. As we look to 2025, Mashreq’s vision to be the region’s most progressive challenger bank is stronger than ever. We will continue to embrace change, leverage technology, deliver client excellence, and drive innovation to shape the future of banking in our markets, ensuring we create lasting value for all our stakeholders.”

Looking Ahead

Mashreq’s performance in 2024 underscores its position as a forward-thinking financial institution that excels in delivering value to stakeholders through innovation, resilience, and a commitment to excellence. The Bank’s ability to achieve record-breaking financial metrics, including double-digit revenue growth and an impressive Return on Equity of 29%, reflects its robust strategy and operational discipline.

As Mashreq continues to prioritize its clients, enhance its digital capabilities, and solidify its financial foundations, it remains steadfast in its mission to foster long-term growth for shareholders while navigating a complex and dynamic global environment. The exceptional credit quality, bolstered by a disciplined risk management framework, and the impressive operational efficiency provide a strong platform for sustained success.

Note: Figures may not add up due to rounding differences

1. Post proposed dividend for the financial year 2024.

Year End 2024 Financial Highlights:

- Total Operating Income increased by 24% in 2024 to AED 13.4 billion, delivering another year of exceptional growth.

- Net Profit Before Tax of AED 9.9 billion, an increase of 12% in 2024 year-on-year and an increase of 71% quarter on quarter.

- 9% year-on-year growth of Net Interest Income, despite a reduced interest rate environment in 2024. Slight reduction in Net interest Margin during 2024 by 26bps to 3.7%.

- Non Interest Income represents 37% of Total Operating Income, with a 63% growth in 2024 to AED 5 billion. Driven by a strategic focus on enhancing fee-based services and leveraging diversified revenue streams and a one-off gain from the partial sale of a subsidiary.

- Net release of AED 166 million in allowances for impairments in 2024, as prudent risk management practices coupled with improving asset quality continues year-on-year.

- Efficiency gains of 339bps in 2024 as cost to income ratio reduced from 31% to 28% year-on-year in 2024.

- Operating expense grew by 11% with investments in growth and technology to increase operational efficiency and expand global presence.

- Despite an AED 869 million tax payment in 2024, Mashreq delivered a Return on Equity (ROE) of 29%, exemplifying its ability to generate exceptional shareholder returns.

- Total Assets in 2024 increased by 11% to reach AED 267 billion and a 5% increase on a quarter on quarter basis. This was supported by strong growth in lending to customers across wholesale and retail. Retail Banking assets grew 9% year-on-year to reach AED 31 billion and Wholesale Banking assets increased by 15% to AED 145 billion.

- Customer Deposits increased to AED 161 billion, a 10% growth in 2024 compared to 2023, with 66% of which is CASA.

- Strong capitalization in 2024 with a Capital Adequacy Ratio of 17.5% , a 100bps improvement year-on-year.

- Non-Performing Loans to Gross Loans Ratio stands at 1.35%, and remains the lowest in the industry.

- 2024 witnessed further strengthening of capital positions with CET1 ratio of 14.5% and Tier 1 ratio of 15.99%, a 75bps and 165bps improvement year-on-year respectively.

FY 2024 Awards:

Click Here Download PDFUAE

Financials