Strong business performance and positive outlook underpinned by robust customer activity and stable macroeconomic environment see Mashreq’s Net Profit in the first half increase by 14% to AED 4bn.

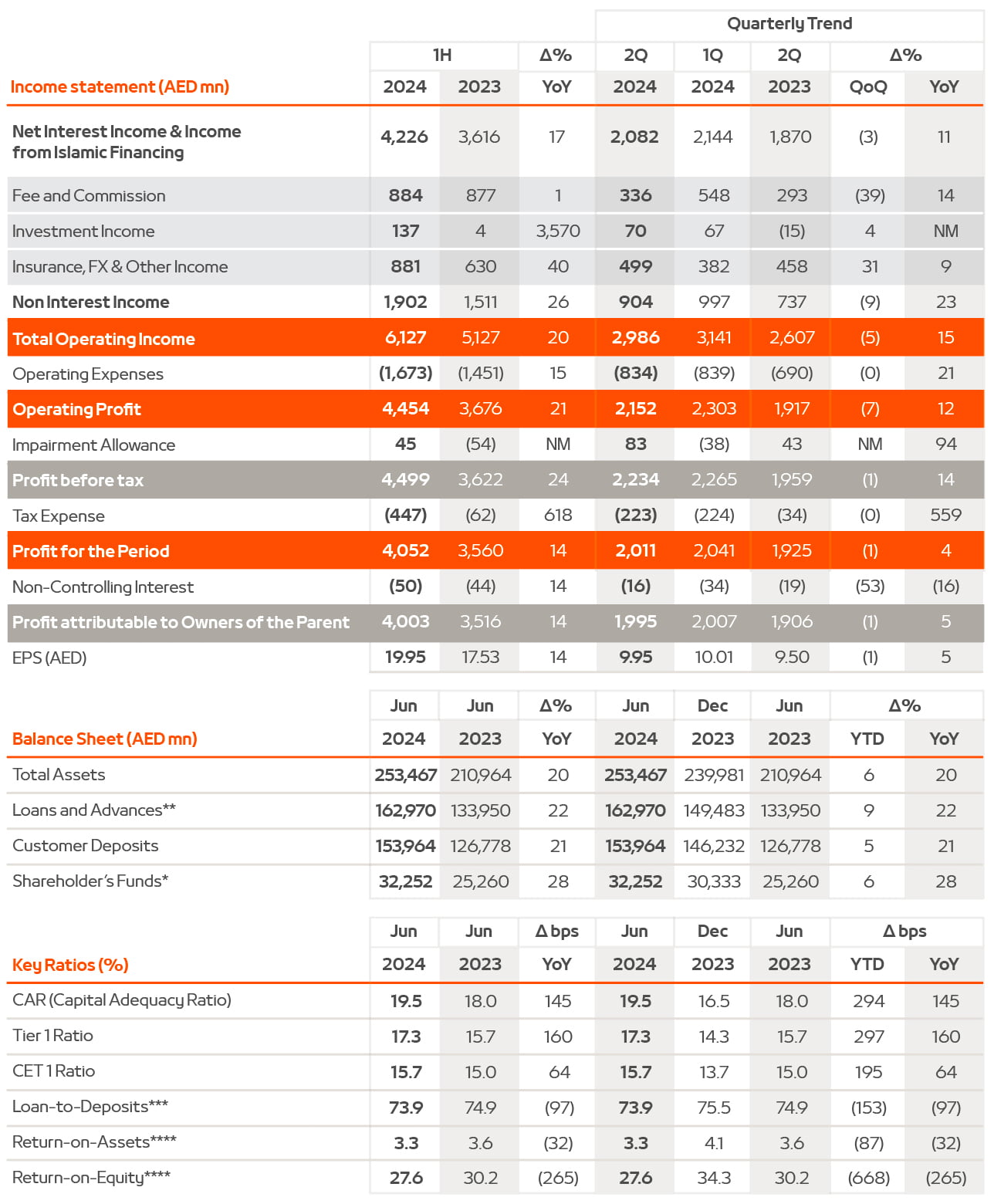

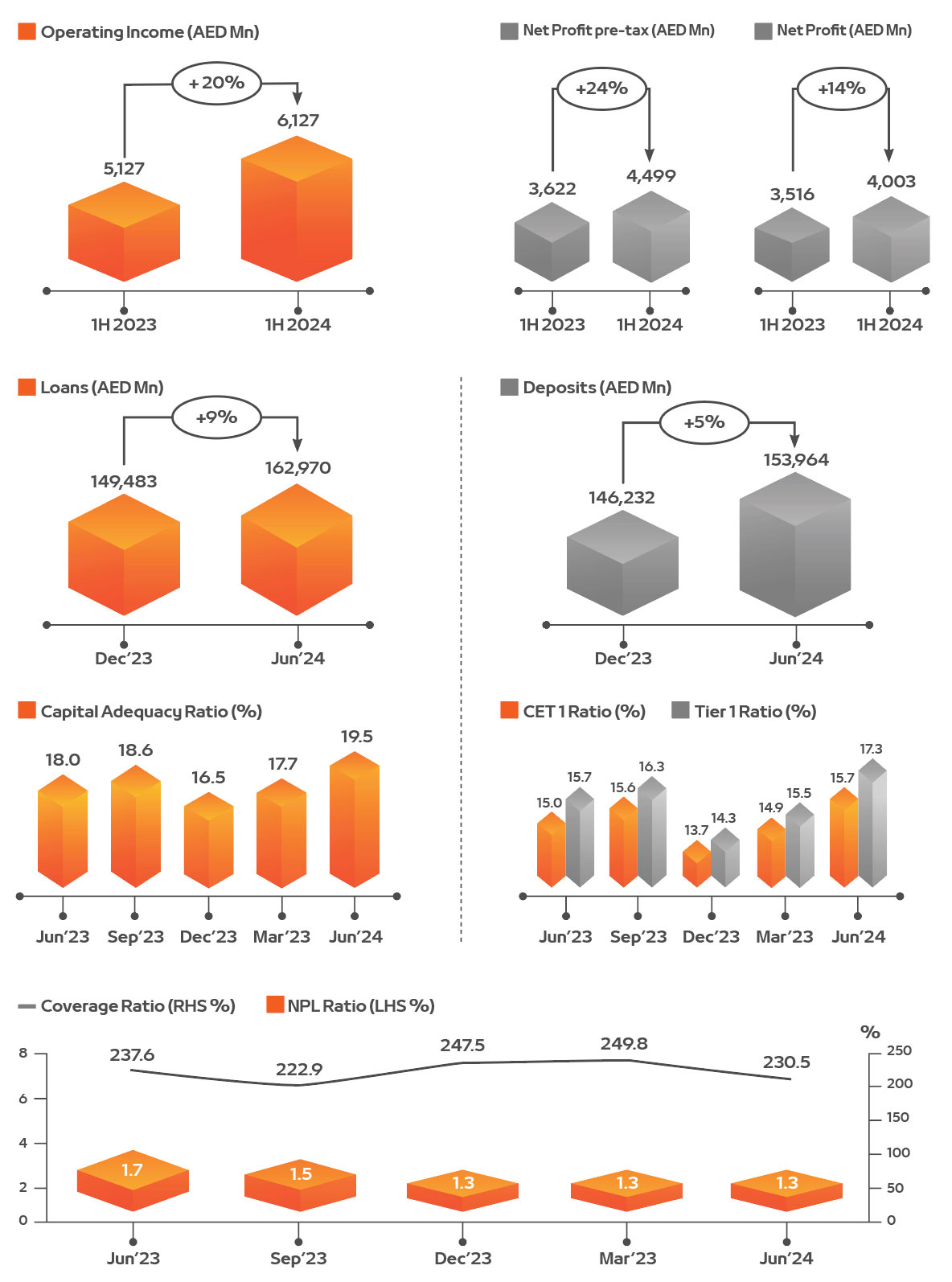

Dubai, UAE: Mashreq is pleased to announce its financial performance for the first half of 2024, highlighting the bank's strong commitment to achieve its strategic goals focused on putting clients first, achieving operational and financial efficiency, maintaining robust risk management, ensuring operational resilience, while fostering a culture that prioritizes its employees. These results emphasize the successful implementation of Mashreq's strategic initiatives capitalizing on providing a world class client experience which is second to none.- Income growth of 20% year-on-year: Net Interest Income grew with 17% driven by a substantial expansion of the balance sheet supported by healthy client margins. Non-interest income saw a marked increase of 26% over prior year and contributed a noteworthy 31% to the total operating income.

- Strong balance sheet growth: The organic growth momentum continued in the second quarter, evidenced by a 9% rise in loans and advances and a 5% increase in customer deposits year-to-date.

- Solid capital position and Operational Efficiency: Capital Adequacy Ratio at 19.5% surpasses regional benchmarks and reflects the financial strength of Mashreq with ample room for further growth. The Return on Equity of 27.6% underscores an efficient use of capital for the benefit of shareholders, while the Cost-Income Ratio of 27.3% demonstrates Mashreq’s operational resilience.

Key Highlights:

- Operating Income & Net Profit

- • Mashreq shows a net profit to shareholders of AED 4.0 billion in the first half of 2024, reflecting a significant 14% increase compared to the same period in the previous year. This growth is largely driven by a 17% year-on-year increase in net interest income. The primary factors contributing to this success include robust business expansion, favorable client margins in the prevailing interest rate environment, and minimal risk costs. In addition, non-interest income rose to AED 1.9 billion, demonstrating a very strong 26% growth year-on-year. The net profit before tax grew by 24% year-on-year and stands at an impressive AED 4.5 billion.

- The Cost-Income ratio improved to 27.3%, highlighting the bank's strong performance. This enhancement is characterized by stringent control over operating expenses, coupled with ongoing investments in client experience improvements as well as business growth.

- Operating profit rose from AED 3.7 billion to AED 4.5 billion in 1H 2024, representing a 21% increase compared to the same period in 2023.

- Risk costs are low at AED 45 million, highlighting the bank’s sensible risk management practices.

- Mashreq's Return on Equity (ROE) reached 27.6% in the first half of 2024, reflecting the management's ongoing commitment to operational efficiency, strategic capital allocation, and delivering optimal value to shareholders. The decrease compared to last year is due to the increase in capital, as returns improved.

- Liquidity & Capital position

- Mashreq's solid liquidity position is indicated by a Liquid Assets ratio of 35.4% and a Liquidity Coverage Ratio of 154.1% as of June 2024.

- The bank's capitalization level is very strong and has further improved from the end of 2023, with a Capital Adequacy Ratio of 19.5%, a Tier 1 Capital Ratio of 17.3%, and a CET1 Ratio of 15.7% as of June 2024.

- Credit Environment & Asset Quality

- The Non-Performing Loans to Gross Loans ratio declined to 1.3% as of end of June 2024 (1.7% as of June 2023) and is one of the lowest in the market. The decline demonstrates the addition of further loans without a simultaneous increase in NPLs.

- The Coverage ratio remains high at 230.5% as on 30th June 2024.

| 14% YoY Net Profit Growth (24% pre-tax) |

AED 4 billion Net profit (AED 4.5 billion pre-tax) |

19.5% Capital Adequacy Ratio |

|||

| 21% Operating Profit Growth |

9% YoY Loans & Advances Growth |

1.3% NPL Gross Loans Ratio |

|||

| 27.6% Return on Equity |

3.3% Return on Assets |

27.3% Cost to Income Ratio |

|||

| 5% YTD Customer Deposits Growth (CASA 62%) |

|||||

H.E. Abdul Aziz Al Ghurair, Chairman of Mashreq:

"The UAE's economy continues to demonstrate remarkable resilience and stability, buoyed by robust policies and a conducive investment environment. As we witness a significant downtrend in inflation, the strength of our nation's economy is further solidified, reflecting strong capital adequacy ratios and increasing foreign investments. This macroeconomic stability has provided a favorable backdrop for Mashreq's continued growth.

Our recent successful pricing of the $500 million additional Tier 1 bond offering, which marked the largest price tightening by any UAE bank in the last five years, underscores our robust financial health and strategic market positioning. The transaction was well distributed across international and regional investors, reaffirming the investor community’s longstanding trust in Mashreq’s credit. Additionally, the upgrade of Mashreq's long-term deposit ratings to A3 with a stable outlook by Moody's is a testament to our sound financial management and resilient operational framework.

Our results for the second quarter keep us on track to deliver strong performance in 2024. We are determined to push forward with our strategic priorities and further improve customer experience, operational performance and risk controls.

We are proud of our achievements and remain committed to our strategic vision of innovation, customer-centric solutions. Our ambition remains unchanged – to be the preferred financial partner for customer success journeys.”

H.E. Abdul Aziz Al Ghurair, Chairman of Mashreq:

"The UAE's economy continues to demonstrate remarkable resilience and stability, buoyed by robust policies and a conducive investment environment. As we witness a significant downtrend in inflation, the strength of our nation's economy is further solidified, reflecting strong capital adequacy ratios and increasing foreign investments. This macroeconomic stability has provided a favorable backdrop for Mashreq's continued growth.

Our recent successful pricing of the $500 million additional Tier 1 bond offering, which marked the largest price tightening by any UAE bank in the last five years, underscores our robust financial health and strategic market positioning. The transaction was well distributed across international and regional investors, reaffirming the investor community’s longstanding trust in Mashreq’s credit. Additionally, the upgrade of Mashreq's long-term deposit ratings to A3 with a stable outlook by Moody's is a testament to our sound financial management and resilient operational framework.

Our results for the second quarter keep us on track to deliver strong performance in 2024. We are determined to push forward with our strategic priorities and further improve customer experience, operational performance and risk controls.

We are proud of our achievements and remain committed to our strategic vision of innovation, customer-centric solutions. Our ambition remains unchanged – to be the preferred financial partner for customer success journeys.”

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq:

"In the first half of the year, we continued to deliver on our strategic ambitions, improving profitability and reporting a strong return on equity, driven by strong commercial momentum, robust customer activity, excellent credit quality, and focused cost management. Our results demonstrate that, despite the challenging global environment, we are making excellent progress on our strategic priorities and achieving industry-leading financial performance. This progress was primarily driven by sustained, strong net interest income, while our high customer activity across the business led to a significant uplift in non-interest income, resulting in a second-quarter return on equity of 27.6%.

We continue to invest in our capabilities to accelerate digital transformation across our business and functions, enhancing customer journeys, improving the customer experience, and reducing costs and operational risks. Additionally, we have completed our Tier 1 capital enhancement to solidify our capital base and support growth.

Our commitment to sustainability is a core focus, driving us to integrate our wide-ranging ESG initiatives and milestones through global initiatives under Climb2Change. This program is expanding across the markets we operate in, highlighting our dedication to accelerating environmental and social impacts and our sustainable finance commitments.

Overall, we are confident that the implementation of our strategy during the first six months has built a robust foundation for continued execution.”

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq:

"In the first half of the year, we continued to deliver on our strategic ambitions, improving profitability and reporting a strong return on equity, driven by strong commercial momentum, robust customer activity, excellent credit quality, and focused cost management. Our results demonstrate that, despite the challenging global environment, we are making excellent progress on our strategic priorities and achieving industry-leading financial performance. This progress was primarily driven by sustained, strong net interest income, while our high customer activity across the business led to a significant uplift in non-interest income, resulting in a second-quarter return on equity of 27.6%.

We continue to invest in our capabilities to accelerate digital transformation across our business and functions, enhancing customer journeys, improving the customer experience, and reducing costs and operational risks. Additionally, we have completed our Tier 1 capital enhancement to solidify our capital base and support growth.

Our commitment to sustainability is a core focus, driving us to integrate our wide-ranging ESG initiatives and milestones through global initiatives under Climb2Change. This program is expanding across the markets we operate in, highlighting our dedication to accelerating environmental and social impacts and our sustainable finance commitments.

Overall, we are confident that the implementation of our strategy during the first six months has built a robust foundation for continued execution.”

Financial Highlights:

Exhibits:

1H 2024 Awards:

Click Here Download PDFUAE

Financials