Dubai, UAE: Mashreq proudly announces its financial results for the fiscal year 2023, showcasing an unwavering commitment to and achievement of a robust and sustainable growth trajectory. The company’s dedication to client centrism and operational excellence is evident in the noteworthy Earnings per Share (EPS) of AED 42.82, a testament to its resilience and ability to create substantial value for shareholders.

- Net Interest Income Skyrockets: Witnessed an impressive 69% surge, fuelled by extraordinary growth in the balance sheet and solid client margins. Concurrently, non-interest income witnessed a robust increase of 13% year-on-year.

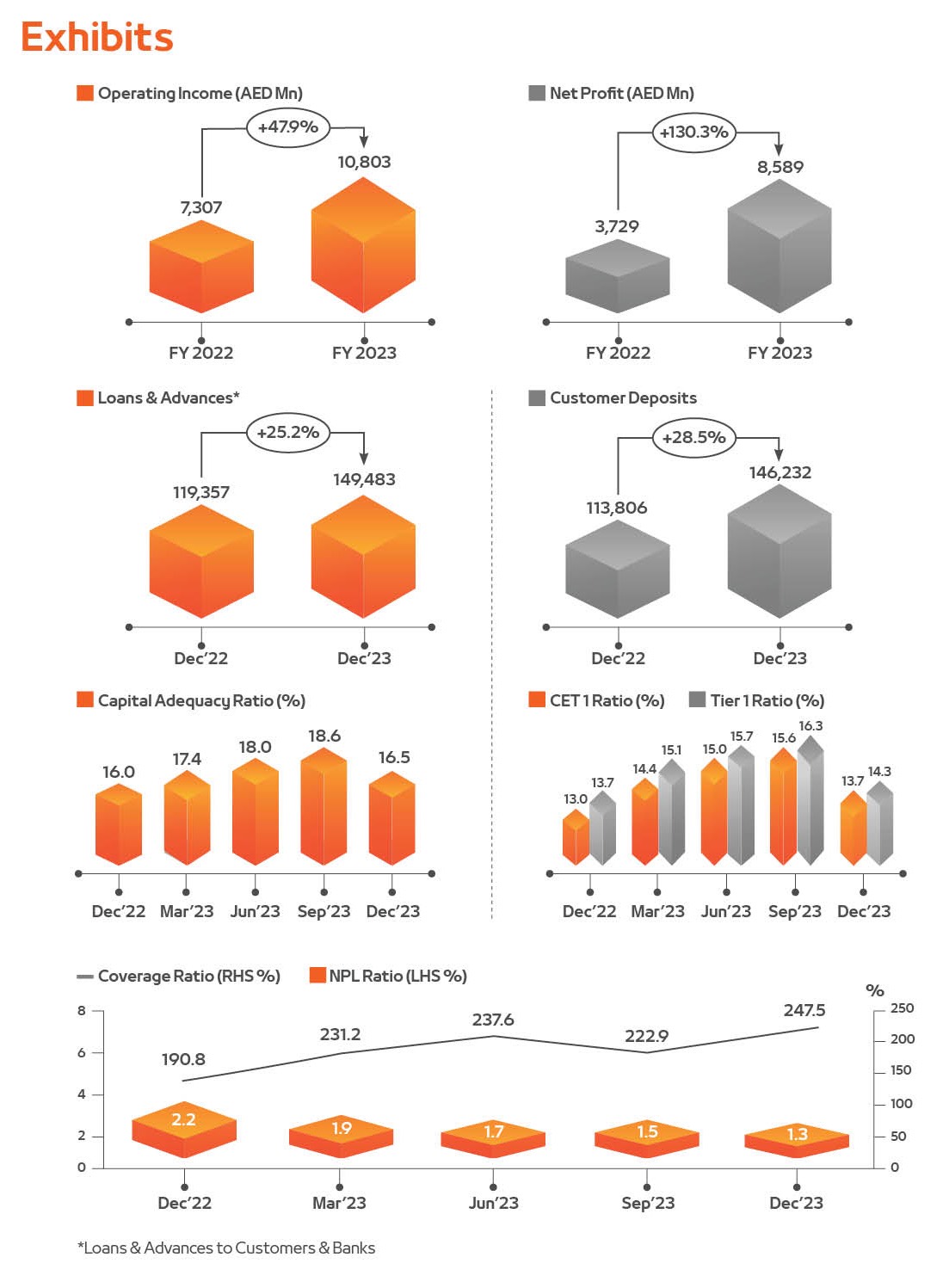

- Dynamic Expansion of Balance Sheet: Marked by a significant 25% year-on-year escalation in Loans and Advances, coupled with a substantial 29% boost in customer deposits, showcasing a strong upward trajectory.

- Financial Strength and Efficiency: The Capital Adequacy Ratio stands at a notable 16.5% (excluding proposed dividend), highlighting Mashreq’s robust financial resilience in a competitive market. Moreover, a stellar Return on Equity (ROE) of 34.3% and an efficient Cost-Income Ratio of 30.9% reflect Mashreq’s exceptional financial performance throughout 2023.

Key Highlights:

- Operating Income & Net Profit

- Mashreq’s Net Profit has surged to a record AED 8.6 billion for FY 2023, a substantial increase of 130% year-on-year. The increase in operating income and net profit is primarily attributed to net interest income soaring by 69% year-on-year. The main drivers are significant business growth with robust client margins, the continuation of the prevailing high-interest rate environment as well as positive one-offs relating to loan loss provisioning. Additionally, our non-interest income has reached AED 3.1 billion, marking a notable 13% year-on-year growth in FY 2023.

- The bank has demonstrated positive jaws of 31.4% in FY 2023, and the Cost-to-Income

- ratio has improved by over 8% year-on-year. This indicates strong business performance with effective control over operating costs while enabling continued investments in enhancing our client experience, risk management, and supporting business growth.

- Operating profit has surged from AED 4.4 billion to AED 7.5 billion in FY 2023,

- representing almost 70% increase compared to the same period in 2022.

- The allowance for impairments has experienced a net release of AED 1.4 billion, driven by prudent risk management, high recoveries from Non-Performing Loans (NPLs) and a one-off release of the General Provision.

- Return on Equity (ROE) at record-high of 34.3% in FY 2023, doubling compared to FY 2022, while the cost-to-income ratio decreased to 30.9%.

- Liquidity & Capital position

- High Liquidity denoted by a Liquid Assets ratio of 33.6% and an efficient Liquidity Coverage Ratio of 134% as of December 2023

- Capitalisation level (excluding proposed dividend) remains robust with the Capital adequacy ratio at 16.5%, Tier 1 Capital ratio at 14.3% and CET1 ratio at 13.7% as of December 2023.

- Credit Environment & Asset Quality

- Overall loan portfolio quality has improved significantly with gross impairments to gross advances at just 0.3% (0.9% in FY 2022)

- The Non-Performing Loans to Gross Loans ratio declined to 1.3% as of end of December 2023 (2.2% as of December 2022) and is one of the lowest in the market.

- The Coverage ratio has improved to 247.5% as on 31st December 2023 (190.8% in December 2022)

| 130% YoY Net Profit Growth |

8.6 billion Net profit (AED) |

16.5% Capital Adequacy Ratio |

|||

| 68.2% Operating Profit Growth |

25% YoY Loans & Advances* Growth |

1.3% NPL gross loans ratio |

|||

| 34.3% Return on equity |

4.1% Return on assets |

30.9% Cost to Income Ratio |

|||

| 29% YTD Customer Deposits Growth (CASA 60%) |

|||||

H.E AbdulAziz Al Ghurair, Chairman of Mashreq:

“In recent years, our track record of consistent performance and profitability improvement has been nothing short of impressive. Our franchise continues to yield outstanding results, bolstered by the addition of a substantial number of new clients and the deepening of existing relationships across the bank. This remarkable achievement mirrors the nation’s significant economic expansion and the resilience and dynamic growth of the UAE’s financial services, setting a precedent in the global banking arena.

Our steadfast dedication to delivering exceptional omnichannel customer experiences remains unwavering, underpinning our pursuit of focused, profitable, and sustainable growth.

Simultaneously, our unceasing investments in enhancing operational efficiency and fortifying risk controls underscore the enduring strength and resilience of our business model. This success owes much to the exceptional talents that grace Mashreq.

The year has been especially significant with the UAE successfully bringing the United Nations Climate Change Conference, COP28, to our nation, a testament to our leadership in addressing global environmental challenges. In alignment with this event, Mashreq has reinforced its commitment to sustainable finance, ensuring that our business strategies are fully integrated with the environmental objectives underscored by COP28.

Our mantra, “Rise Every Day,” has transcended mere words to become an intrinsic part of our organisational DNA. It serves as a guiding beacon, illuminating our path and influencing our actions and decisions in every facet of our business.

With the UAE banking sector reaching a historic high, and total assets crossing the AED 4 trillion mark, we look forward to 2024 with a sense of optimism and readiness to uphold and extend this trajectory of dynamic and continued growth.”

H.E AbdulAziz Al Ghurair, Chairman of Mashreq:

“In recent years, our track record of consistent performance and profitability improvement has been nothing short of impressive. Our franchise continues to yield outstanding results, bolstered by the addition of a substantial number of new clients and the deepening of existing relationships across the bank. This remarkable achievement mirrors the nation’s significant economic expansion and the resilience and dynamic growth of the UAE’s financial services, setting a precedent in the global banking arena.

Our steadfast dedication to delivering exceptional omnichannel customer experiences remains unwavering, underpinning our pursuit of focused, profitable, and sustainable growth.

Simultaneously, our unceasing investments in enhancing operational efficiency and fortifying risk controls underscore the enduring strength and resilience of our business model. This success owes much to the exceptional talents that grace Mashreq.

The year has been especially significant with the UAE successfully bringing the United Nations Climate Change Conference, COP28, to our nation, a testament to our leadership in addressing global environmental challenges. In alignment with this event, Mashreq has reinforced its commitment to sustainable finance, ensuring that our business strategies are fully integrated with the environmental objectives underscored by COP28.

Our mantra, “Rise Every Day,” has transcended mere words to become an intrinsic part of our organisational DNA. It serves as a guiding beacon, illuminating our path and influencing our actions and decisions in every facet of our business.

With the UAE banking sector reaching a historic high, and total assets crossing the AED 4 trillion mark, we look forward to 2024 with a sense of optimism and readiness to uphold and extend this trajectory of dynamic and continued growth.”

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq:

“Our performance this year has truly been exceptional, serving as a testament to the success of our strategic direction within the ever-evolving global economic and political landscape. As a modern, digitally empowered challenger bank, we have firmly cemented our position in the market.

Our strategy and robust operational execution have been pivotal in achieving this growth which spans across all businesses and geographies. Our consistent recognition by prestigious institutions like Euromoney Market Leaders across local, regional, and international levels, driven by votes from our clients, reaffirms our commitment to delivering superior customer experiences and pioneering innovative technology.

Our AED 110 billion (USD 30 Billion) 2030 commitment to sustainable finance announced during COP28, is part of our “Climb2Change” global initiative, which integrates the bank’s wide spectrum of ESG milestones and its impactful contributions to facilitating the finance required to combat climate change and a net zero inclusive future.

Internationally, the benefits of our diversified business model have become notably evident. We have achieved robust growth in our international operations, notably expanding into new markets such as Pakistan and Oman. Additionally, our intensified efforts in well-established markets like the UK, Hong Kong, and the US is primed to fuel future growth. Furthermore, our heightened focus on established markets, within the GCC, India and Egypt, further solidifying our growth prospects.

Looking ahead, our course and position remain resolute, even in the face of ongoing uncertainty. We possess a stable, robust, and resilient business model, characterised by high-quality earnings and a well-diversified loan portfolio spanning our various markets. It is imperative, however, that we brace ourselves for the normalisation of interest rates, which will necessitate adjustments in operational strategies to align with this new reality.

Nevertheless, our formidable presence within the banking sector, underpinned by a wealth of intellectual capital, an unwavering commitment to leveraging technology to enhance clients experience, and a prudent approach to risk management, will empower us to maintain our prominent market position.”

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq:

“Our performance this year has truly been exceptional, serving as a testament to the success of our strategic direction within the ever-evolving global economic and political landscape. As a modern, digitally empowered challenger bank, we have firmly cemented our position in the market.

Our strategy and robust operational execution have been pivotal in achieving this growth which spans across all businesses and geographies. Our consistent recognition by prestigious institutions like Euromoney Market Leaders across local, regional, and international levels, driven by votes from our clients, reaffirms our commitment to delivering superior customer experiences and pioneering innovative technology.

Our AED 110 billion (USD 30 Billion) 2030 commitment to sustainable finance announced during COP28, is part of our “Climb2Change” global initiative, which integrates the bank’s wide spectrum of ESG milestones and its impactful contributions to facilitating the finance required to combat climate change and a net zero inclusive future.

Internationally, the benefits of our diversified business model have become notably evident. We have achieved robust growth in our international operations, notably expanding into new markets such as Pakistan and Oman. Additionally, our intensified efforts in well-established markets like the UK, Hong Kong, and the US is primed to fuel future growth. Furthermore, our heightened focus on established markets, within the GCC, India and Egypt, further solidifying our growth prospects.

Looking ahead, our course and position remain resolute, even in the face of ongoing uncertainty. We possess a stable, robust, and resilient business model, characterised by high-quality earnings and a well-diversified loan portfolio spanning our various markets. It is imperative, however, that we brace ourselves for the normalisation of interest rates, which will necessitate adjustments in operational strategies to align with this new reality.

Nevertheless, our formidable presence within the banking sector, underpinned by a wealth of intellectual capital, an unwavering commitment to leveraging technology to enhance clients experience, and a prudent approach to risk management, will empower us to maintain our prominent market position.”

Exhibits:

FY 2023 Awards:

Click HereUAE

Financials